ANZ FastPay New Zealand app for iPhone and iPad

Developer: ANZ Bank New Zealand Limited

First release : 27 Jul 2022

App size: 27.31 Mb

ANZ FastPay is a mobile payment solution that allows you to accept EFTPOS, Visa and Mastercard payments on the go anywhere, anytime.

If you are new to ANZ FastPay, before you can use the app, you’ll need to apply for a Card Reader. Please contact us on 0800 473 453 to complete the application process.

ANZ FastPay comes with a contactless-enabled Card Reader that allows your customers to simply tap, insert or swipe their card to process a payment. The ANZ Card Reader connects to your compatible* smartphone.

With more customers able to pay you on the spot, you can spend less time chasing payments, and more time chasing the jobs you love.

ANZ FastPay:

• Convenient – accept payments from your customers via a range of card and mobile wallet options:

- EFTPOS, Visa and Mastercard credit and debit cards

- Mobile wallets (customers can tap their mobile device to pay)

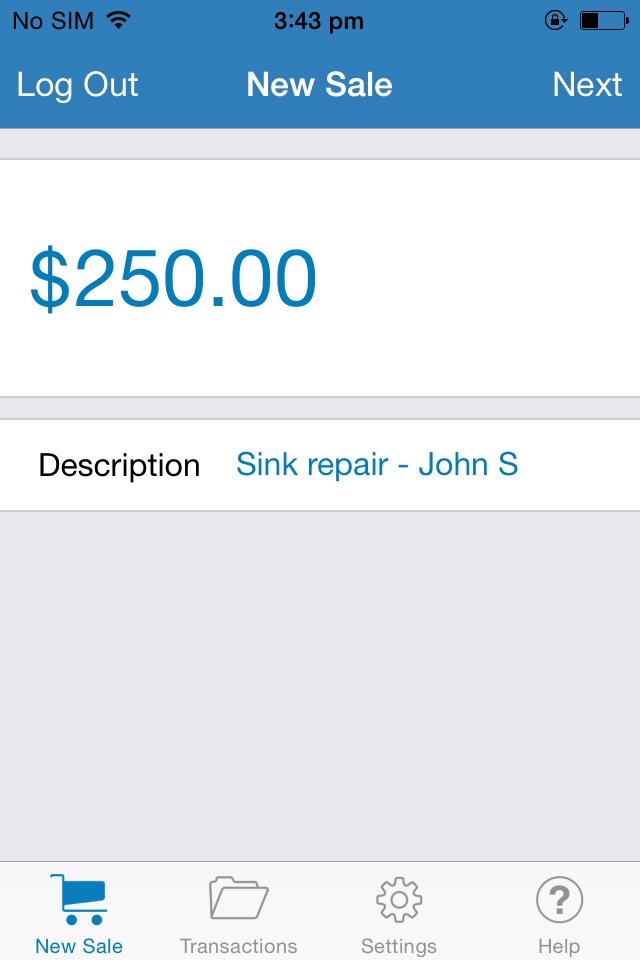

• Anywhere, anytime - payments can be taken wherever the job is done**. Perfect for mobile businesses such as plumbers and personal trainers.

• Excellent for your cash flow – access your takings the next business day (for transactions processed before 10pm Monday to Friday).

• Quick - with your ANZ FastPay Card Reader ask the customer to tap, insert or swipe their card to process a payment.

• Flexible - no long-term contracts.

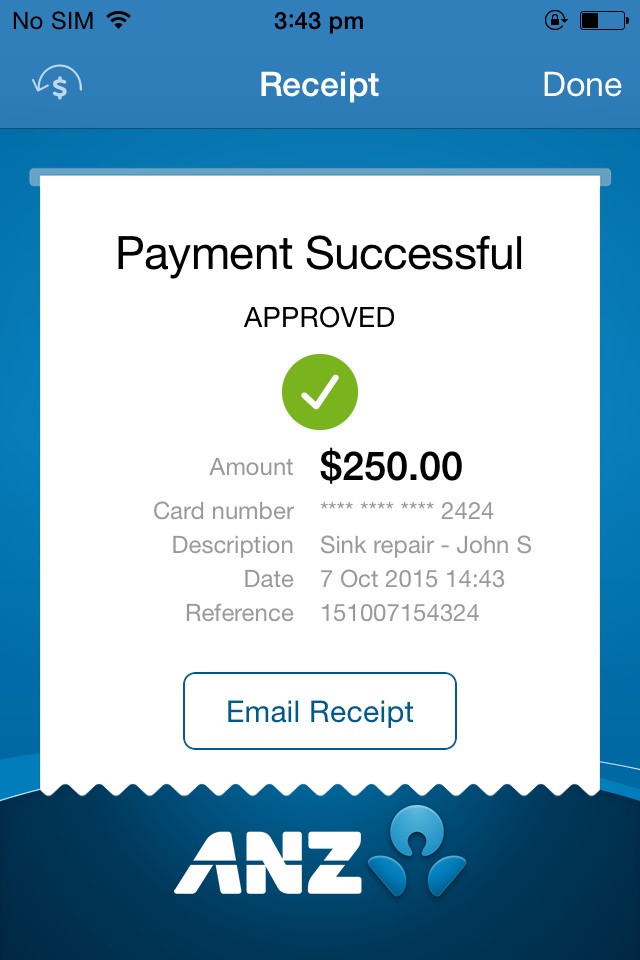

• Receipts - email your customer a receipt through the app.

• Compliant - ANZ FastPay meets strict industry security standards. ANZ FastPay does not allow for card, or card PIN data to be stored on your smartphone, the ANZ FastPay app or the ANZ FastPay Card Reader.

• Refunds - when necessary, you can process refunds through ANZ FastPay for your customers.

*Compatible devices and firmware:

For a full list of devices and minimum operating systems that ANZ FastPay is compatible with, see anz.co.nz/fastpay.

ANZ FastPay Fees:

Merchant Service Fee:

2.60% of Visa and Mastercard credit card (and international debit card) transactions.

0.95% of Visa and Mastercard debit card contactless transactions.

EFTPOS transactions:

No transaction fee when the customer chooses ‘Cheque’ or ‘Savings’ and swipes or inserts their card when making a payment.

Monthly card reader support fee:

$23 plus GST per user.

Set-up fee:

$99 plus GST per user.

No long-term contract or closure administration fee.

For a demo video, FAQs and more info, visit anz.co.nz/FastPay.

How we use analytics:

We use third party analytics website measurement software to help us measure the performance of ANZ FastPay. Third party analytics is used to anonymously aggregate ANZ FastPay statistics, such as number of page views, the number of unique visitors, time spent on ANZ FastPay, timing of visits and types of devices used to access ANZ FastPay.

This information is used to carry out statistical analysis of aggregate user behaviour. The analysis is provided to us by the third party to help us better understand usage of ANZ FastPay. We do not make any personal information or information about your transactions or accounts available to the third party.

For further information about the analytics we use see http://www.google.com/analytics, and for details of the third party analytics Privacy Policy see http://www.google.com/policies/privacy.

ANZ FastPay is only available to approved merchants who meet ANZ’s credit approval criteria and have an ANZ Business Account. Terms, conditions and fees apply.

**Use of ANZ FastPay requires a cellular or wireless internet connection.

ANZ Bank New Zealand Limited.